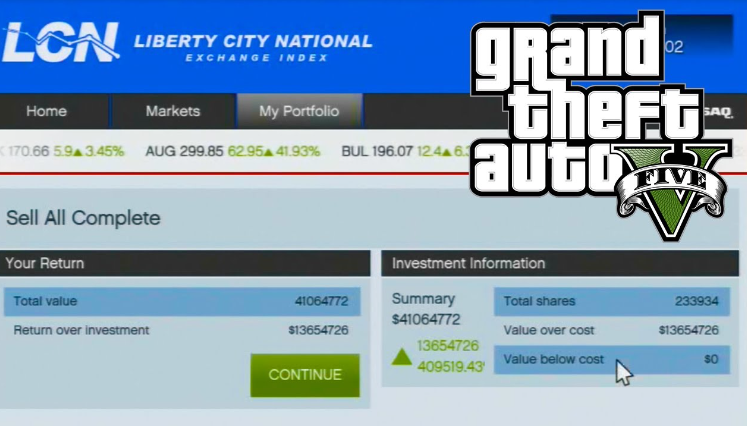

GTA 5 Stock Market Guide: Maximizing Profits in Los Santos

The stock market in Grand Theft Auto V (GTA 5) offers players a unique opportunity to earn substantial profits within the game's virtual economy. Understanding how the stock market functions and strategically investing can lead to significant financial gains for players. In this comprehensive guide, we will explore the intricacies of the GTA 5 stock market and provide valuable tips to help you maximize your profits in the bustling city of Los Santos.

GTA 5 system

1. Section 1: Stock Market Basics

1.1 What is the Stock Market? The stock market refers to a platform where investors can buy and sell shares of publicly traded companies. It provides companies with a means to raise capital by offering shares to the public, and investors can participate in the market by purchasing these shares.

1.2 The Role of Stock Exchanges Stock exchanges act as the central marketplace for buying and selling stocks. Examples of well-known stock exchanges include the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange (LSE). These exchanges facilitate the trading of stocks and ensure fair and transparent transactions.

1.3 Key Participants in the Stock

Market Understanding the roles of various participants in the stock market is crucial. These include:

1.3.1 Investors: Individuals or institutions that purchase shares of companies with the expectation of earning a return on their investment.

1.3.2 Stockbrokers: Licensed professionals who facilitate the buying and selling of stocks on behalf of investors. They execute trades and provide advisory services to clients.

1.3.3 Stock Analysts: Experts who analyze and evaluate companies' financial performance, industry trends, and market conditions to provide investment recommendations.

1.3.4 Market Makers: Entities, often brokerage firms, that ensure liquidity in the market by constantly quoting bid and ask prices for stocks. They buy and sell shares to maintain an orderly trading environment.

1.4 Stock Market Indices Stock market indices track the performance of a group of stocks representing a specific sector, market, or country. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and FTSE 100. These indices provide a snapshot of the overall market performance.

1.5 Market Orders and Limit Orders Understanding the types of orders used in stock trading is essential. Market orders are executed at the current market price, while limit orders allow investors to specify the maximum price they are willing to pay (buy limit) or the minimum price they are willing to accept (sell limit) for a stock.

1.6 Stock Market Risks Investing in the stock market carries inherent risks. Market volatility, economic factors, company-specific risks, and unexpected events can influence stock prices. It is crucial for investors to assess and manage these risks to protect their investments.

1.7 Resources for Stock Market Research Numerous resources are available to conduct research and gain insights into the stock market. These include financial news outlets, company annual reports, analyst reports, and online brokerage platforms that provide real-time market data and analysis.

2. Section 2: Stock Market Strategies

2.1 Fundamental Analysis: Fundamental analysis involves evaluating a company's financial health, including its revenue, earnings, assets, and liabilities. Investors analyze factors such as the company's competitive position, management team, industry trends, and economic conditions to determine the intrinsic value of a stock.

2.2 Technical Analysis Technical analysis involves studying stock price patterns, volume, and market trends to make investment decisions. Traders use various technical indicators and chart patterns to identify entry and exit points, as well as to assess the stock's potential future price movements.

2.3 Value Investing Value investing focuses on identifying undervalued stocks that have the potential for long-term appreciation. Investors look for companies with solid fundamentals, strong balance sheets, and a stock price that is trading below its intrinsic value. The goal is to buy stocks at a discount and hold them until the market recognizes their true worth.

2.4 Growth Investing Growth investing involves identifying companies with strong growth potential. Investors seek out stocks of companies that are expected to experience above-average growth in revenue, earnings, and market share. This strategy often involves investing in innovative industries or emerging markets.

2.5 Dividend Investing Dividend investing involves selecting stocks of companies that regularly distribute a portion of their earnings as dividends to shareholders. Investors seek out companies with a history of stable or increasing dividend payments. This strategy aims to generate regular income from the dividend payments and potentially benefit from capital appreciation.

2.6 Index Investing Index investing involves investing in a broad market index, such as the S&P 500 or NASDAQ, through index funds or exchange-traded funds (ETFs). This strategy aims to replicate the performance of the overall market, providing diversification and long-term growth potential.

3. Section 3: Stock Manipulation Techniques

3.1 Pump and Dump: Pump and dump schemes involve artificially inflating the price of a stock through false or misleading statements to attract investors. Once the price rises, the manipulators sell their shares, causing the stock price to plummet and leaving unsuspecting investors with losses.

3.2 Insider Trading: Insider trading occurs when individuals with access to non-public information about a company trade stocks based on that information. This practice is illegal as it gives those with insider knowledge an unfair advantage over other investors.

3.3 Front-Running: Front-running is when brokers or traders execute trades based on non-public information before fulfilling orders for their clients. This allows them to profit from the anticipated price movement resulting from their clients' trades.

3.4 Churning: Churning involves excessive buying and selling of stocks by brokers to generate commissions, rather than based on the investors' best interests. The frequent trades increase transaction costs and can erode the investor's portfolio value.

3.5 Wash Trading: Wash trading involves creating artificial trading activity by buying and selling the same stock to create the appearance of volume and price movement. The purpose is to attract other investors to trade the stock, leading to increased liquidity and potential price manipulation.

3.6 Bear Raid: A bear raid occurs when a group of investors intentionally attempts to drive down the price of a stock by aggressively selling large volumes of shares. This creates panic and encourages other investors to sell, further driving down the stock price.

GTA 5 stock market guide

Mastering the stock market in GTA 5 requires knowledge, strategy, and a keen understanding of market dynamics. By following the guidance provided in this comprehensive guide, you will be equipped with the tools and insights necessary to maximize your profits and achieve financial success in the bustling city of Los Santos. So, get ready to dive into the exciting world of the GTA 5 stock market and embark on a journey towards virtual wealth and prosperity.