Chime Bank Name: A Comprehensive Guide to the Online Banking Revolution

In recent years, online banking has experienced a significant transformation, and one name that has emerged as a prominent player in the industry is Chime Bank. With its innovative approach and user-friendly features, Chime Bank has revolutionized the way people manage their finances. This comprehensive guide will delve into the various aspects of Chime Bank, including its features, benefits, and how it stands out from traditional banking institutions. So let's explore the world of Chime Bank and discover why it has become a game-changer in the financial industry.

I. What is Chime Bank?

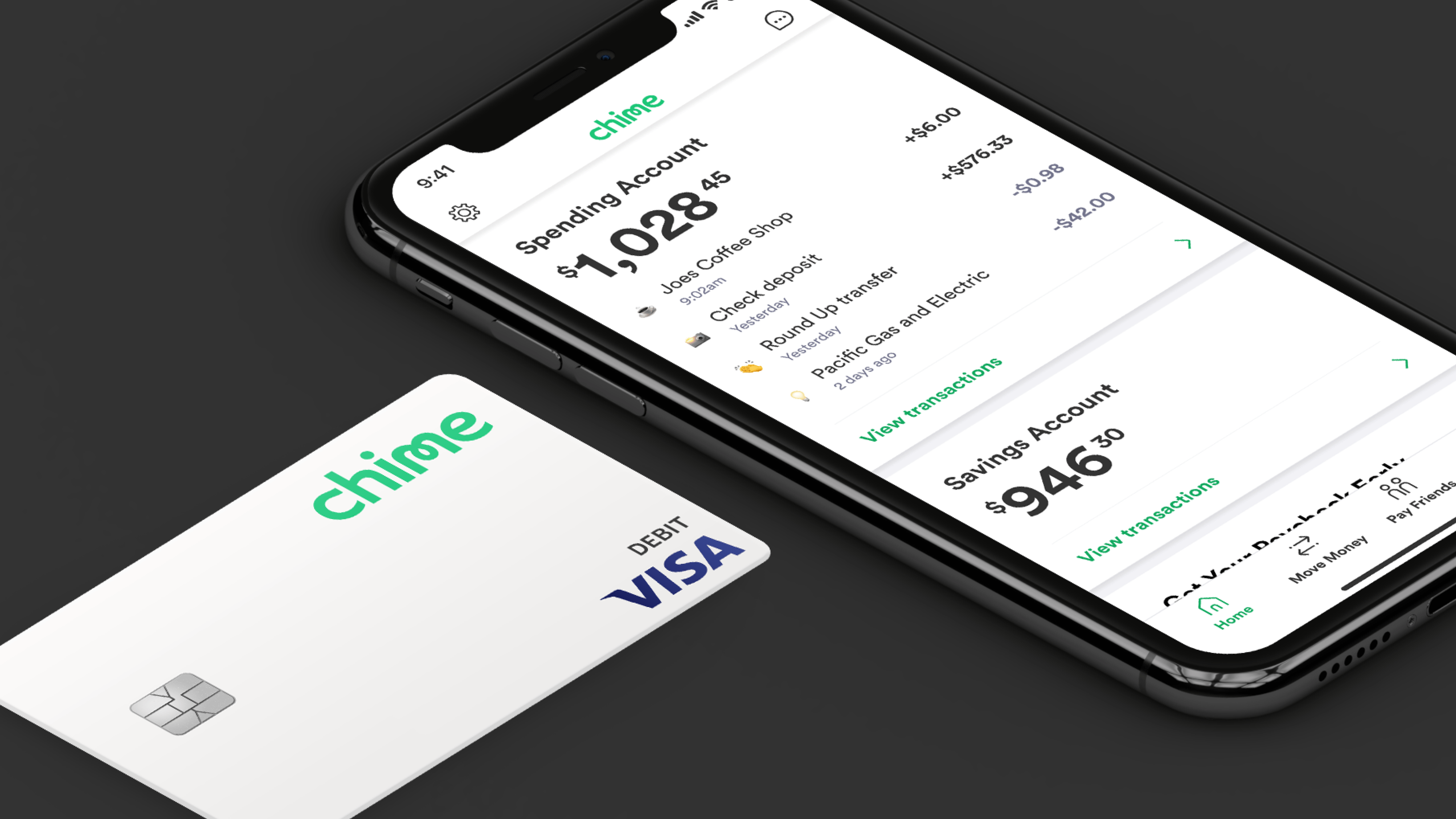

Chime Bank is a leading online banking platform that offers a range of financial services and features. Unlike traditional brick-and-mortar banks, Chime Bank operates entirely online, allowing customers to access their accounts and manage their money conveniently from their mobile devices or computers.

Chime Bank logo on smartphone

With Chime Bank, users can perform various banking activities such as depositing checks, making payments, and tracking their expenses in real-time.

II. Key Features of Chime Bank:

1. Fee-Free Banking: One of the standout features of Chime Bank is its commitment to offering fee-free banking. Unlike traditional banks that charge monthly maintenance fees and overdraft fees, Chime Bank provides users with a no-fee banking experience.

This means customers can save more of their hard-earned money without worrying about unnecessary charges.

2. Early Direct Deposit: Chime Bank understands the importance of getting paid on time. With their early direct deposit feature, users can receive their paychecks up to two days earlier than the traditional banking system.

This feature can be particularly beneficial for individuals who rely on their paycheck to cover their expenses promptly.

3. Automatic Savings: Chime Bank promotes healthy saving habits through its automatic savings feature. Customers can set up automatic transfers from their spending account to their savings account, allowing them to effortlessly save a portion of their income.

This feature helps individuals build an emergency fund or work towards achieving their financial goals.

Chime Bank with Automatic Savings Features

4. Real-Time Notifications: Stay updated on your finances with Chime Bank's real-time notifications. Users receive instant alerts on their mobile devices for transactions, account balances, and other account activities.

This feature provides a sense of security and keeps users informed about their financial situation at all times.

III. Benefits of Choosing Chime Bank:

1. Convenience: Chime Bank eliminates the need to visit physical bank branches, enabling customers to manage their accounts from anywhere at any time.

With just a few taps on their mobile devices, users can perform banking transactions, check their balances, and stay on top of their finances effortlessly.

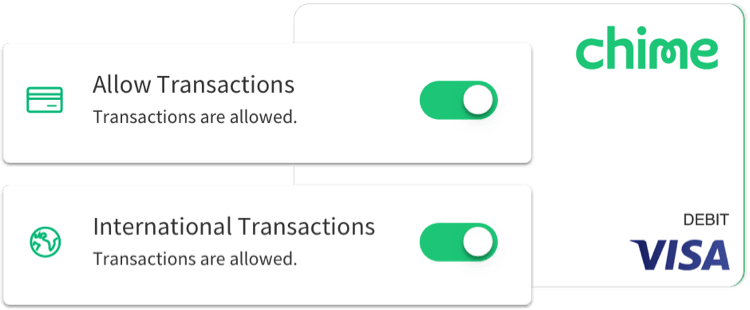

2. Enhanced Security: Chime Bank prioritizes the security of its customers' accounts and personal information. With advanced encryption techniques and robust security measures, Chime Bank ensures that users' data remains safe and protected.

Additionally, their real-time notifications allow users to spot any suspicious activities and report them immediately.

Card Security Mobile

3. Money Management Tools: Chime Bank offers a suite of money management tools that help users gain insights into their spending habits and make informed financial decisions.

These tools provide budgeting assistance, expense categorization, and even saving challenges, empowering users to take control of their finances effectively.

IV. How Chime Bank Differs from Traditional Banks:

1. Branchless Banking: Unlike traditional banks that operate through physical branches, Chime Bank operates solely online. This approach eliminates the need for customers to visit physical locations and provides them with the flexibility to manage their finances on their own terms.

2. Mobile-First Approach: Chime Bank is built with a mobile-first approach, recognizing the increasing reliance on mobile devices for banking activities. The intuitive mobile app offers a seamless banking experience, making it easy for users to perform transactions and access account information on the go.

Chime Bank Mobile-First Approach

3. Customer-Centric Focus: Chime Bank places a strong emphasis on customer satisfaction. With their responsive customer support team and user-friendly interface, they aim to provide an exceptional banking experience. Chime Bank's focus on customer-centricity sets it apart from traditional banks that may have complex processes and less responsive support.

V. Conclusion:

Chime Bank has emerged as a trailblazer in the online banking industry, redefining the way people manage their money. With its fee-free banking, innovative features, and customer-centric approach, Chime Bank offers a compelling alternative to traditional banking institutions.

Whether you're looking for convenience, enhanced security, or robust money management tools, Chime Bank has something to offer. Embrace the online banking revolution with Chime Bank and experience a seamless, hassle-free financial journey.