Unlocking Greater Spending Power: How to Get More Spending Power on Zip

In today's fast-paced world, financial flexibility and the ability to make purchases without breaking the bank are highly coveted. Zip, a popular buy now, pay later (BNPL) service, has gained prominence for its convenience. This article explores strategies to maximize your spending power on Zip, allowing you to enjoy more of life's pleasures without straining your budget.

How to get more spending power on zip?

1. Understanding Zip's Basics

Before diving into strategies to boost your spending power, it's crucial to have a solid grasp of how Zip works. Zip is a BNPL service that allows you to make purchases and pay for them later in equal installments.

Familiarize yourself with its terms, such as repayment schedules, fees, and credit limits.

2. Improve Your Credit Score

One of the most effective ways to enhance your spending power on Zip is by improving your credit score. A higher credit score can lead to increased credit limits, lower fees, and better terms.

Pay your bills on time, reduce outstanding debts, and manage your finances wisely to boost your creditworthiness.

3. Responsible Spending Habits

Using Zip responsibly is key to getting more spending power.

Avoid overextending yourself by purchasing items beyond your means. Stick to a budget and only use Zip for essential purchases or planned expenses.

Responsible spending will help you maintain a healthy financial relationship with Zip.

4. Leverage Promotions and Discounts

Zip often partners with retailers to offer exclusive promotions and discounts to its users. Keep an eye out for these deals, as they can significantly increase your spending power.

Utilize coupons, special offers, and cashback incentives to get more value from your purchases.

5. Increase Your Income

Earning more money can directly impact your spending power. Consider exploring additional income streams, such as freelancing, part-time work, or selling items you no longer need.

The extra income can provide you with more funds to make purchases through Zip.

6. Pay Off Existing Balances

If you have outstanding Zip balances, focus on paying them off as quickly as possible.

Clearing your debts will free up your available credit, allowing you to make new purchases. Prioritize high-interest balances to minimize the fees you incur.

7. Request a Credit Limit Increase

Once you've established a positive payment history with Zip, don't hesitate to request a credit limit increase. A higher credit limit means more spending power.

Be prepared to provide financial information that demonstrates your ability to manage increased credit responsibly.

8. Optimize Your Repayment Schedule

Zip offers various repayment schedules, including weekly, bi-weekly, and monthly options.

Choose the schedule that aligns best with your income and expenses. Selecting a schedule that matches your cash flow can make it easier to manage your Zip payments.

9. Diversify Your Payment Methods

While Zip offers convenience, it's essential to diversify your payment methods. Relying solely on Zip can limit your financial options.

Maintain traditional payment methods like credit cards or debit cards to ensure you have flexibility when making purchases.

10. Monitor Your Account Regularly

Stay vigilant about monitoring your Zip account. Keep track of your transactions, account balances, and upcoming payments.

Being proactive in managing your account will help you avoid late fees and keep your spending power intact.

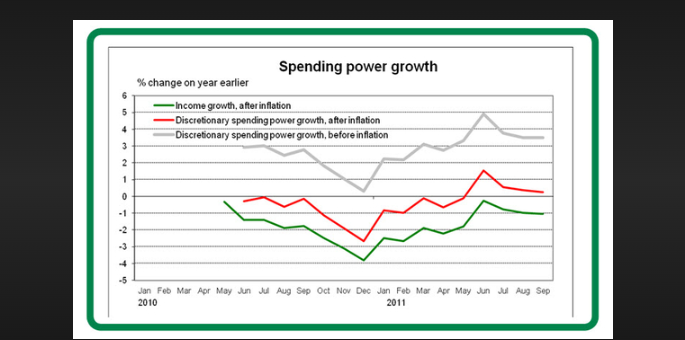

Spending power growth

Zip offers a convenient way to make purchases without immediate financial strain, and with the right strategies, you can get more spending power on Zip. By understanding how Zip works, improving your credit score, practicing responsible spending habits, and leveraging promotions, you can unlock greater financial flexibility and enjoy the benefits of this popular BNPL service. Remember that responsible financial management is the key to making the most of Zip's offerings while maintaining your financial well-being.