How to Use Goat Credit: A Comprehensive Guide

Goat Credit is a financial tool that provides users with a flexible and convenient way to manage their spending and finances. If you're curious about how to use Goat Credit effectively or are considering incorporating it into your financial strategy, you've come to the right place. In this comprehensive guide, we will walk you through the ins and outs of Goat Credit, ensuring you have a clear understanding of how to maximize its benefits.

How to use goat credit?

I. Introduction to Goat Credit

Goat Credit is a financial service that allows individuals to make purchases, access credit, and manage their financial transactions.

It operates on a credit-based system, offering users the flexibility to pay for goods and services over time.

II. Understanding Goat Credit

To use Goat Credit effectively, it's important to understand its key components:

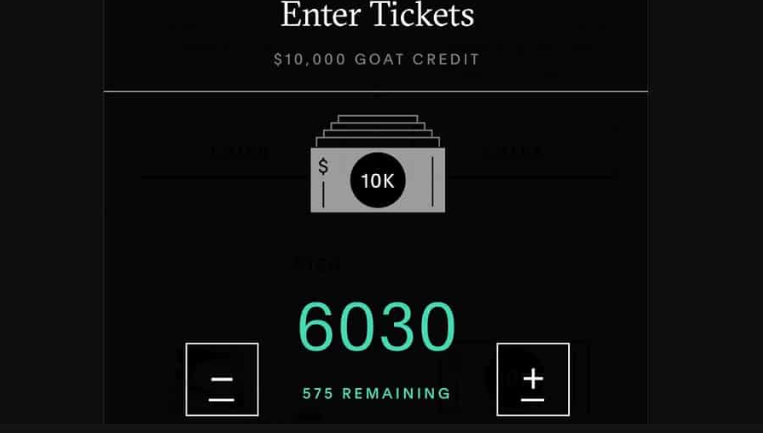

1. Credit Limit: Goat Credit provides users with a predetermined credit limit, which represents the maximum amount they can spend using the service.

2. Interest Rates: Interest rates may apply to outstanding balances if users do not pay off their purchases within the specified billing cycle.

3. Billing Cycle: Goat Credit typically operates on a monthly billing cycle, with users receiving statements outlining their purchases and balances.

4. Repayment Options: Users have the option to make minimum monthly payments or pay off their entire balance, depending on their financial situation.

III. Steps to Use Goat Credit

Here's a step-by-step guide on how to use Goat Credit effectively:

1. Application: Start by applying for Goat Credit. This often involves providing personal and financial information for a credit assessment.

2. Approval: Once approved, you will receive your credit limit and access to the Goat Credit service.

3. Making Purchases: You can use Goat Credit to make purchases online or at participating retailers, just like a regular credit card.

4. Review Statements: Periodically, you will receive statements outlining your purchases, balances, and payment due dates.

5. Repayment: Make payments based on your chosen repayment plan. It's essential to pay at least the minimum required amount to avoid late fees and interest charges.

6. Responsible Usage: To maintain a positive credit history, use Goat Credit responsibly by staying within your credit limit and making timely payments.

IV. Benefits of Using Goat Credit

Using Goat Credit can offer several benefits:

1. Flexibility: Goat Credit provides flexibility in managing your expenses, allowing you to pay over time rather than all at once.

2. Convenience: It's a convenient way to make purchases, especially for larger or unexpected expenses.

3. Build Credit: Responsible use of Goat Credit can help build or improve your credit history, which can be valuable for future financial endeavors.

4. Safety: It offers security features like fraud protection and the ability to dispute unauthorized charges

V. Tips for Responsible Goat Credit Usage

To make the most of Goat Credit while avoiding potential pitfalls, consider these tips:

1. Budget: Have a budget in place to ensure you can comfortably cover your Goat Credit payments.

2. Timely Payments: Always make payments on time to avoid late fees and interest charges.

3. Credit Limit: Be mindful of your credit limit and avoid maxing it out, as it can negatively impact your credit score.

4. Read Terms: Familiarize yourself with the terms and conditions of Goat Credit, including interest rates and fees.

Goat Credit is a versatile financial tool

Goat Credit is a versatile financial tool that can simplify your spending and payment management. By understanding how it works, using it responsibly, and following the provided tips, you can make the most of Goat Credit while maintaining control over your finances. Whether you're looking to make a significant purchase or improve your credit history, Goat Credit can be a valuable asset in your financial toolkit.