Navigating the Process: Adjustment and Correction of Posted Items

In the world of finance, accuracy is paramount. However, mistakes can and do happen. Whether it's a simple data entry error or a more complex discrepancy, financial institutions need a streamlined process to make adjustments and corrections to posted items. In this article, we'll explore what this process entails, why it's crucial, and how it impacts various sectors.

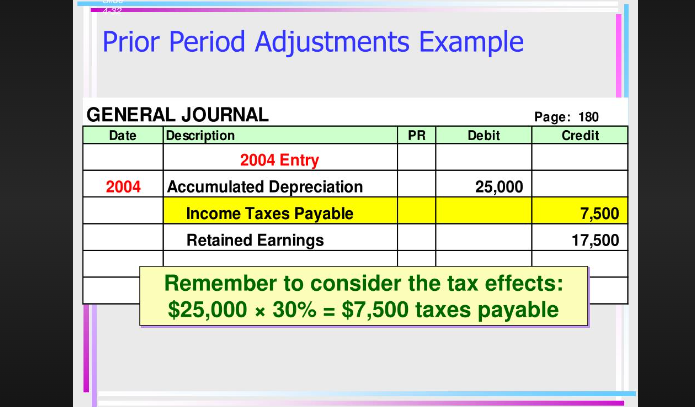

Prior period adjustments example

1. Understanding the Need for Adjustments and Corrections

-

Data Entry Errors: Human errors are inevitble. Transposing numbers, omitting decimals, or entering incorrect values can lead to discrepancies in financial records.

-

-

Accounting Mistakes: Accountants might make errors when recording transactions, leading to inaccuracies in financial statements.

-

-

External Factors: Economic changes, regulatory updates, or external audits can reveal discrepancies that need correction.

2. The Role of Financial Institutions

Financial institutions play a pivotal role in the adjustment and correction process.

They are responsible for ensuring that financial records are accurate, reliable, and in compliance with regulatory standards. This is crucial for maintaining the trust of clients and investors.

3. Importance in Banking

-

Customer Accounts: For banks, ensuring accurate account balances is paramount. Any discrepancies can result in customers being overcharged or undercharged.

-

-

Fraud Detection: Detecting fraudulent activities and unauthorized transactions is a critical part of the adjustment process.

-

-

Loan Management: Accurate records are essential for loan management. Corrections may be needed to rectify interest rate errors or adjust repayment schedules.

4. Significance in Accounting

-

Financial Statements: Inaccuracies in financial statements can lead to misleading information for investors, creditors, and decision-makers.

-

-

Auditing: External auditors rely on accurate financial records. Adjustments are made to ensure that the financial statements present a true and fair view of a company's financial position.

5. Government and Regulatory Impact

-

Taxation: Tax authorities may require corrections to ensure the proper calculation of taxes owed.

-

-

Regulatory Compliance: Industries like healthcare and finance are heavily regulated. Corrections may be needed to comply with changing regulations.

6. The Adjustment/Correction Process

-

Identification: First, the error or discrepancy must be identified. This can be through internal audits, customer complaints, or routine reconciliations.

-

-

Investigation: The root cause of the error is investigated to prevent it from recurring.

-

-

Correction: The necessary adjustments are made to rectify the error. This can involve updating records, amending financial statements, or refunding customers.

-

-

Verification: The corrections are verified for accuracy. This step is critical in ensuring that the issue is truly resolved.

-

-

Documentation: Proper documentation of the adjustment process is essential for audit trails and compliance.

-

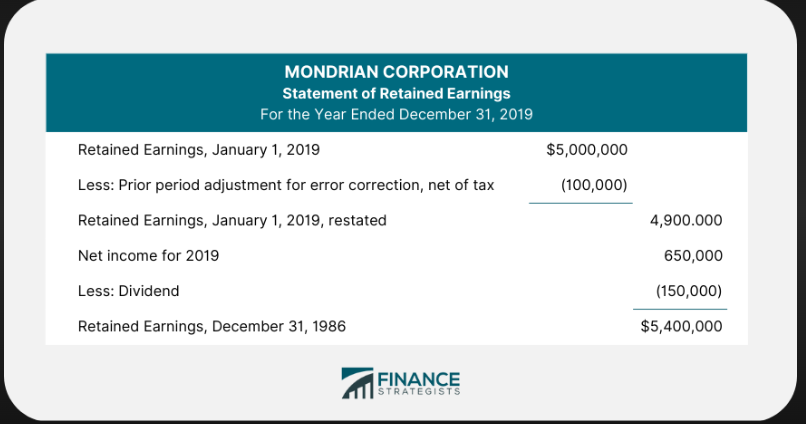

Mondrian comporation

The adjustment and correction of posted items are integral processes in the financial world. They ensure accuracy, compliance, and the trust of stakeholders. Financial institutions and organizations must have robust procedures in place to swiftly identify, investigate, and rectify errors to maintain their reputation and integrity in a complex and demanding industry.