Unveiling the Significance of an "Eighteen Dollars Check"

In the realm of financial transactions, the "eighteen dollars check" has garnered attention for its unique value. This article delves into the significance, uses, and intricacies of this specific monetary instrument. Exploring its history, legal aspects, and practical applications, we shed light on why an "eighteen dollars check" is more than just a piece of paper.

I. Understanding the Basics of an Eighteen Dollars Check:

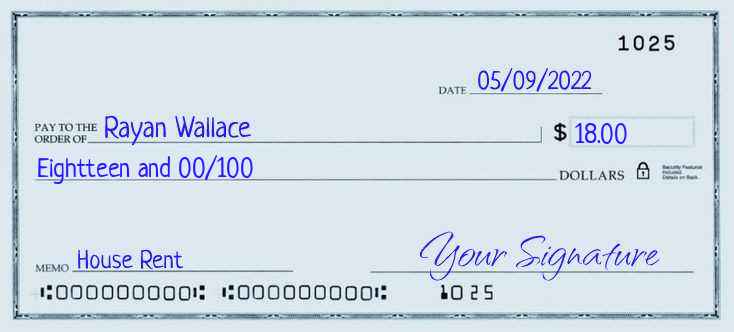

An "eighteen dollars check" is a negotiable instrument, commonly referred to as a check, with a specific monetary value of eighteen dollars. This type of check holds its own significance due to its easily recognizable amount, distinguishing it from other denominations.

Eighteen Dollars Check

II. The Historical Evolution of Checks:

To comprehend the importance of the "eighteen dollars check," it's essential to trace the historical evolution of checks. From ancient civilizations using promissory notes to modern banking systems, checks have streamlined financial transactions. The specificity of the "eighteen dollars check" might have roots in the practicality of this particular amount for various transactions.

III. Legal Aspects and Validity:

Legally, an "eighteen dollars check" is binding once issued by the drawer (the person who writes the check) to the payee (the recipient). This check represents a written instruction to the bank to transfer eighteen dollars from the drawer's account to the payee's account. It's vital for both parties to understand their rights and responsibilities when dealing with such a check to avoid disputes.

IV. Practical Applications and Use Cases:

1. Retail Transactions: The "eighteen dollars check" might be used for retail purchases or bill payments, especially for small to medium-sized expenses.

2. Peer-to-Peer Transactions: Friends or family members might exchange "eighteen dollars checks" as gifts, loans, or reimbursements for minor expenses.

3. Charity and Donations: Non-profit organizations could utilize these checks for micro-donations or fundraising initiatives.

Charity and Donations

4. Educational Purposes: Schools or educational institutions might issue "eighteen dollars checks" as incentives or rewards for academic achievements.

V. Potential Challenges and Considerations:

1. Processing Fees: Depending on the bank and account type, processing fees might affect the practicality of using "eighteen dollars checks" for transactions.

2. Endorsement: The correct endorsement process is crucial to ensure the smooth processing of the check.

Endorsement

3. Banking Regulations: Adherence to local and international banking regulations is necessary to prevent legal complications.

VI. Security Measures for "Eighteen Dollars Checks":

Enhanced security features are essential to prevent fraud and unauthorized use of "eighteen dollars checks." These measures could include watermarking, unique serial numbers, and holographic elements to ensure the authenticity of the instrument.

VII. Conclusion:

In conclusion, the "eighteen dollars check" carries significance beyond its face value. It serves as a testament to the evolution of financial transactions, legal intricacies, and practical applications in modern society.

Whether used for retail, personal, or philanthropic purposes, understanding the nuances of this seemingly simple instrument adds depth to our financial literacy and awareness. As technology advances, the "eighteen dollars check" continues to occupy a distinctive place in the ever-changing landscape of monetary transactions.