How to Block Someone on Zelle Wells Fargo: A Comprehensive Guide

In the digital age, online banking platforms like Zelle have revolutionized the way we transfer money. However, there might be situations where you need to block someone on Zelle, especially if you use Wells Fargo as your banking partner. This guide will provide you with step-by-step instructions on how to block someone on Zelle through Wells Fargo's online platform. Whether it's a troublesome acquaintance or a security concern, we've got you covered.

1. Section 1: Understanding the Need to Block Someone on Zelle

Understanding the Need to Block Someone on Zelle

In this section, we'll delve into the reasons why you might need to block someone on Zelle:

Privacy Concerns: When you have concerns about sharing your financial information with a specific individual.

Unwanted Transactions: Preventing unauthorized or unwanted money transfers.

Safety and Security: Shielding yourself from potential scams or fraudulent activities.

2. Section 2: The Step-by-Step Guide to Blocking Someone on Zelle via Wells Fargo

The Step-by-Step Guide to Blocking Someone on Zelle via Wells Fargo

Follow these straightforward steps to block someone on Zelle through your Wells Fargo account:

Log In to Your Wells Fargo Account: Visit the official Wells Fargo website and log in to your account using your credentials.

Navigate to Zelle: Once logged in, find the Zelle option in your account dashboard and click on it.

Access Settings: Look for the "Settings" or "Manage Contacts" option within the Zelle section and click on it.

Locate the Person to Block: Find the person you want to block from the list of your Zelle contacts. This might involve scrolling if you have a lengthy contact list.

Block the Person: Once you've located the person, you should see an option to block them. Click on it, and confirm your decision when prompted.

Confirmation: You'll receive a confirmation message stating that the person has been successfully blocked on Zelle.

3. Section 3: Comparing Blocking Features on Different Banking Platforms

In this section, we'll compare the process of blocking someone on Zelle across various banking platforms:

|

Banking Platform |

Blocking Process Ease |

Additional Features |

|

Wells Fargo |

Simple and intuitive |

Fraud protection |

|

Chase |

User-friendly |

Quick transfers |

|

Bank of America |

Straightforward |

Transaction history |

4. Section 4: Tips for Effective Blocking and Security

To ensure the security of your transactions, follow these tips:

Regularly Review Contacts: Periodically review your Zelle contacts and remove any unfamiliar or unwanted individuals.

Use Strong Passwords: Maintain a strong and unique password for your online banking account.

Beware of Phishing: Be cautious of emails or messages asking for your banking details. Always verify the source.

Enable Two-Factor Authentication: Strengthen your account security by enabling two-factor authentication if available.

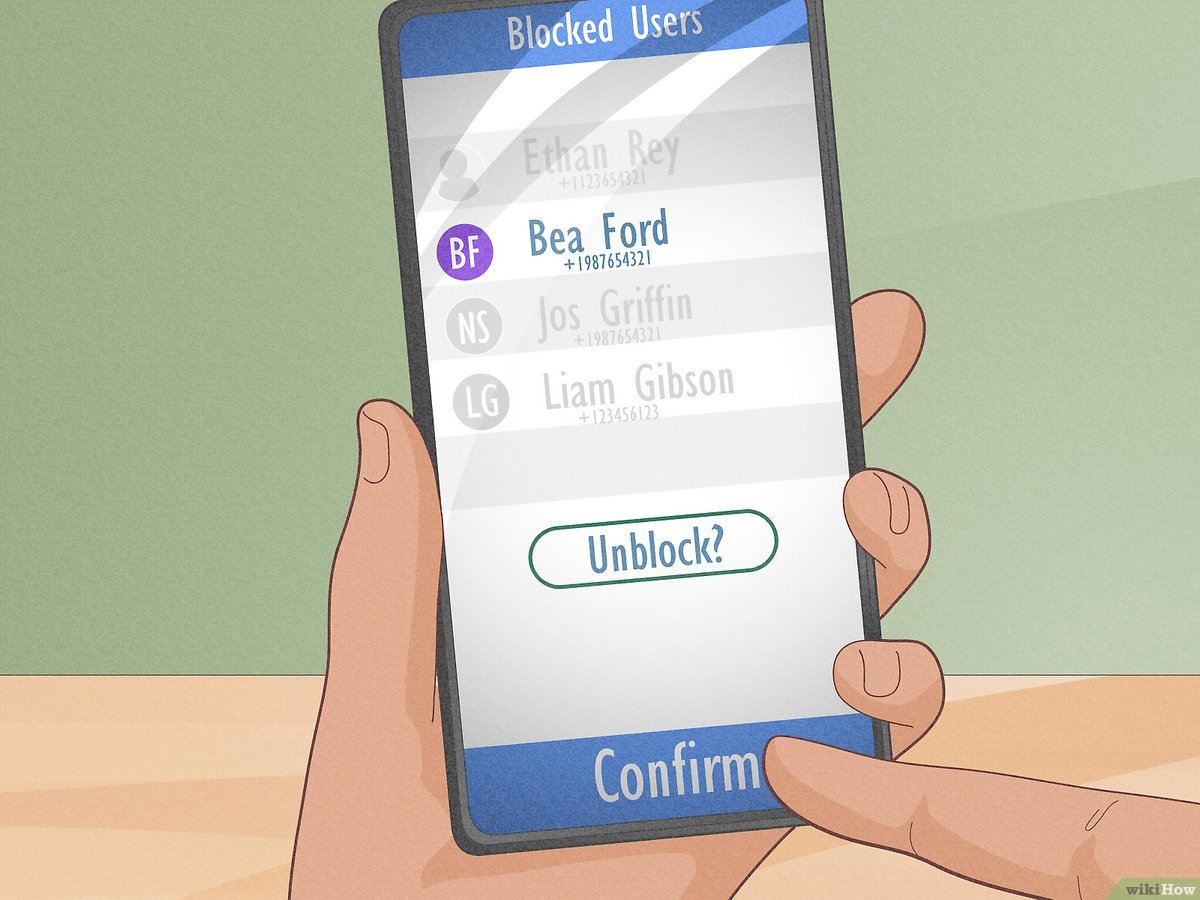

5. Section 5: Unblocking on Zelle

What if you change your mind? Here's how to unblock someone on Zelle:

Access Settings: Follow the same steps to access the Zelle settings within your Wells Fargo account.

List of Blocked Contacts: Look for the list of contacts you've blocked on Zelle.

Unblock: Find the person you want to unblock, click on them, and choose the "Unblock" option. Confirm your decision.

Confirmation: Receive a confirmation that the person has been successfully unblocked on Zelle.

Blocking someone on Zelle through Wells Fargo is a simple yet effective way to enhance your online banking security and maintain control over your transactions. By following the steps outlined in this guide, you can safeguard your financial information and enjoy a worry-free experience while using Zelle for money transfers via Wells Fargo. Remember, staying vigilant and keeping up with best security practices will always be your best defense in the digital world.