How to Close a Chime Account: A Step-by-Step Guide

Closing a Chime account can be a straightforward process if you follow the right steps. Whether you've found a better banking alternative or simply want to consolidate your accounts, this guide will walk you through the process of closing your Chime account. In this article, we will provide you with a step-by-step guide on how to close a Chime account, ensuring that your financial affairs are handled properly and efficiently.

Close a Chime Account

Section 1: Understanding Chime Account Closure

1.1 What is Chime?

Before we dive into the process of closing a Chime account, let's briefly understand what Chime is.

Chime is an online banking platform that offers a range of services, including checking and savings accounts, as well as a Chime Visa® Debit Card.

1.2 Reasons to Close a Chime Account

There can be various reasons why you might want to close your Chime account. Some common reasons include:

- Switching to a different banking provider

- Consolidating multiple accounts into one

- Dissatisfaction with Chime's services or fees

- Relocation to a country where Chime is not available

Section 2: Preparing to Close Your Chime Account

2.1 Assessing Your Account

Before proceeding with the closure, take some time to review your Chime account. Ensure that all pending transactions are completed, and consider transferring any remaining funds to another account.

2.2 Notifying Automatic Payments and Deposits

If you have any automatic payments or deposits linked to your Chime account, make sure to update them with your new banking information. This ensures that you won't face any disruptions in your financial obligations.

Section 3: Initiating the Chime Account Closure

3.1 Contacting Chime Support

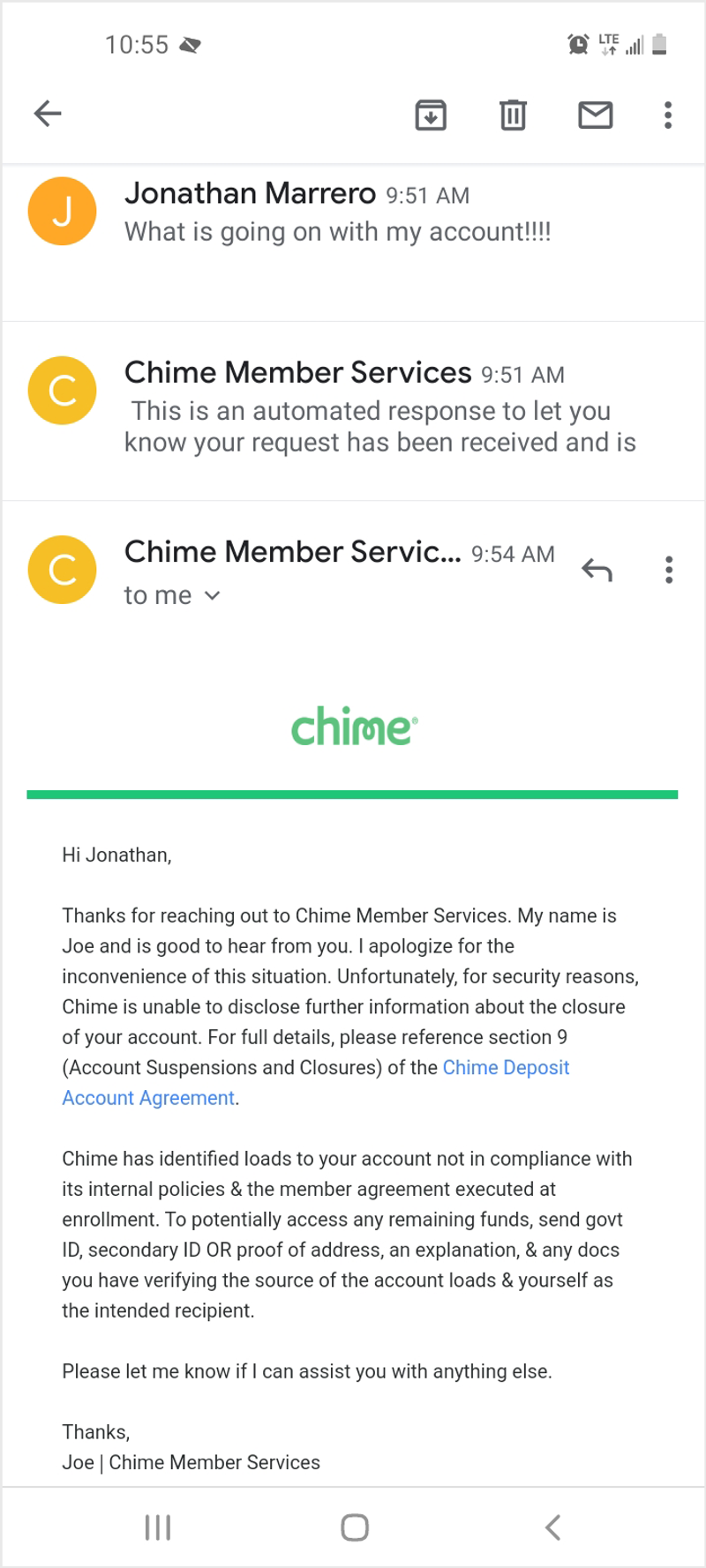

To initiate the closure process, you need to contact Chime Support. You can reach them through various channels, such as phone, email, or their official website's live chat feature. Request their assistance in closing your Chime account.

3.2 Providing Required Information

During your interaction with Chime Support, you will be asked to provide certain information to verify your identity.

This may include your full name, account details, and security-related questions.

Ensure that you have this information readily available to facilitate the closure process.

3.3 Requesting Closure Confirmation

Once you've provided the necessary information, make sure to request a closure confirmation from Chime Support.

This will serve as proof that you've initiated the closure process and will be valuable for future reference, if needed.

Close a Chime Account

Section 4: Post-Closure Actions

4.1 Confirming Account Closure

After initiating the account closure, it's essential to verify that your Chime account has been successfully closed.

Contact Chime Support again if you haven't received confirmation within the specified timeframe.

4.2 Updating Direct Deposit and Bill Payments

If you had any direct deposit or bill payment arrangements linked to your Chime account, ensure that you update them with your new banking details.

This will prevent any potential disruptions in your income or payment obligations.

4.3 Reviewing Credit Reports

To ensure there are no discrepancies or errors, it's a good practice to review your credit reports after closing your Chime account.

This helps you stay informed about your financial status and identify any unauthorized activity.

Closing a Chime account can be a simple and hassle-free process if you follow the right steps. By understanding the necessary procedures and taking appropriate actions, you can ensure a smooth closure while safeguarding your financial interests. Remember to review your account, notify automatic payments, contact Chime Support, and update your financial arrangements to avoid any complications. With this step-by-step guide, you can confidently close your Chime account and explore new banking opportunities that better suit your needs.