Is Vanguard Free: Exploring the Cost Structure of Vanguard Investments

Vanguard is a well-known investment management company that offers a wide range of investment products and services to individual and institutional investors. One common question that arises among potential investors is whether Vanguard is free to use. In this article, we will delve into the cost structure of Vanguard investments to understand the fees and expenses associated with their services. By the end, you will have a clear understanding of whether Vanguard is truly free or not.

Vanguard banner

1. Understanding Vanguard:

Before diving into the cost structure, it's important to have a basic understanding of Vanguard and its offerings.

Vanguard is renowned for its low-cost investment options, including mutual funds, exchange-traded funds (ETFs), individual stocks, bonds, and more.

Their philosophy centers around providing investors with access to diversified portfolios at competitive costs.

2. Fund Expense Ratios:

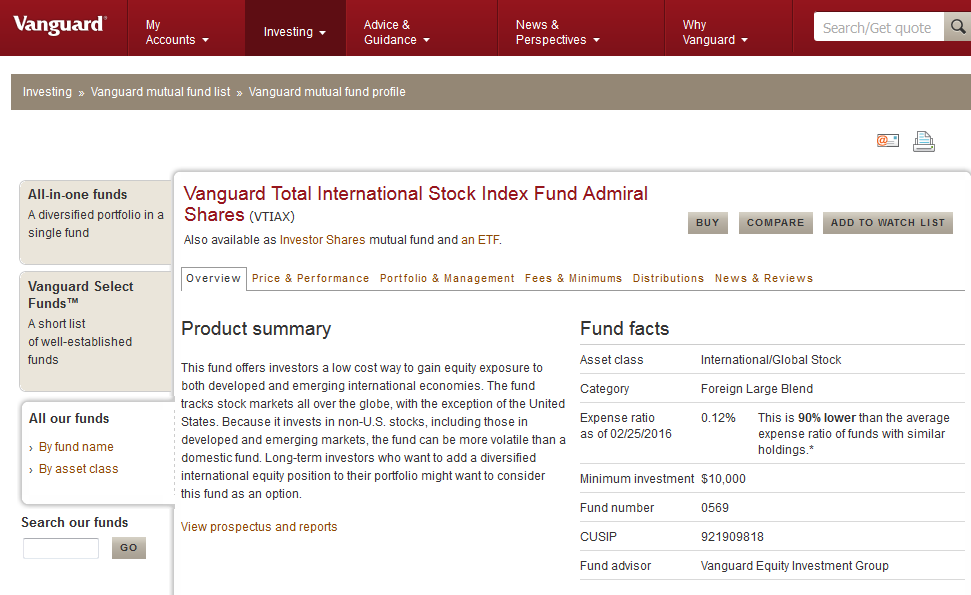

One of the key components to consider when assessing the cost of investing with Vanguard is the expense ratios of their funds.

An expense ratio is an annual fee charged by mutual funds and ETFs to cover their operating expenses.

Vanguard is known for its industry-leading low expense ratios, which are significantly lower compared to many other investment management firms.

While the exact expense ratio varies by fund, Vanguard's commitment to low-cost investing is a major selling point for investors.

3. Commission-Free Trading:

Vanguard offers commission-free trading for a wide range of its own mutual funds and ETFs.

This means that investors can buy and sell these specific Vanguard products without incurring trading fees.

However, it's important to note that trading fees may still apply for non-Vanguard funds and individual stocks or bonds.

4. Account Service Fees:

While Vanguard is generally known for its low-cost approach, it's important to be aware of certain account service fees that may apply.

For example, Vanguard charges an annual account maintenance fee for certain types of accounts, such as individual accounts with lower balances.

However, these fees are typically waived for investors who meet specific criteria, such as maintaining a certain account balance or signing up for electronic document delivery.

5. Financial Advisor Fees:

If you choose to work with a financial advisor at Vanguard, it's important to note that there may be additional fees associated with their services.

These fees are separate from the expenses associated with the underlying funds and are typically based on a percentage of your invested assets or a fixed fee structure.

The specific fees and arrangements will vary based on the type and level of service provided by the advisor.

6. Additional Considerations:

While Vanguard strives to offer low-cost investing options, it's crucial to consider other potential costs that may arise.

For example, if you engage in frequent trading or make certain transactions, there may be additional fees or charges. Additionally, taxes on capital gains and dividends from your investments should be taken into account.

IRA Account Cost Schedule

While Vanguard is known for its low-cost approach to investing, it's important to understand that certain fees and expenses may apply. The expense ratios of Vanguard funds are generally competitive and offer investors access to diversified portfolios at a low cost. Vanguard also offers commission-free trading for many of its own funds and provides options for fee waivers based on certain criteria. However, account service fees and financial advisor fees may be applicable in certain situations. It's essential to carefully review and understand the specific costs associated with your Vanguard investments to make informed decisions.