How to Start Over on TurboTax: A Step-by-Step Guide

TurboTax is a popular software used for filing taxes, and sometimes you may need to start over if you encounter errors or want to make significant changes to your tax return. In this article, we will provide you with a comprehensive guide on how to start over on TurboTax. Whether you need to reset your progress or make a fresh start with a new return, we've got you covered.

TurboTax is a popular software used for filing taxes

1. Section 1: Assessing the Need to Start Over

Reasons to Start Over: Before diving into the process, let's explore common reasons why you might want to start over on TurboTax. We will discuss scenarios such as incorrect data entry, changes in financial circumstances, or a desire for a fresh start.

2. Section 2: Resetting Your Progress

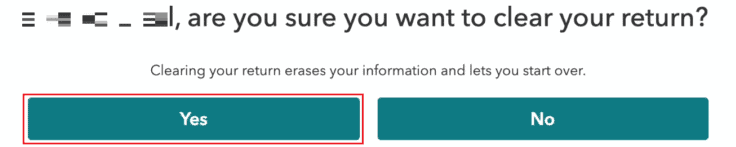

2.1 Exiting TurboTax: If you need to start over from the beginning, we will guide you through the process of exiting TurboTax and ensuring that your progress is reset.

2.2 Clearing Browser Cache and Cookies: In some cases, simply exiting TurboTax may not be enough to reset your progress. We will provide instructions on how to clear your browser cache and cookies, ensuring a clean start when you reopen TurboTax.

3. Section 3: Starting a New Tax Return

3.1 Creating a New Account: If you wish to start a new tax return from scratch, we will walk you through the process of creating a new TurboTax account. This step is necessary if you want to separate your new return from any previous filings.

3.2 Selecting the Correct Tax Year: TurboTax offers different versions for each tax year. We will guide you through the process of selecting the appropriate tax year for your new return.

3.3 Entering Personal and Financial Information: Once you've created a new account and selected the correct tax year, we will explain how to enter your personal and financial information accurately.

4. Section 4: Importing Previous Year's Data (Optional)

4.1 Assessing the Need for Data Import: If you want to carry forward certain information from a previous tax return, we will help you determine whether importing data is necessary.

4.2 Importing Previous Year's Data: If data import is required, we will provide instructions on how to import the relevant information from a previous TurboTax return.

5. Section 5: Filling Out Your New Tax Return

5.1 Answering New Questions: As you start a new tax return, you may encounter different questions based on your specific situation. We will guide you through the process of answering these questions accurately and thoroughly.

5.2 Entering New Income and Deductions: We will provide guidance on entering new income sources, deductions, and credits into your new tax return.

6. Section 6: Reviewing and Filing Your New Return

6.1 Reviewing Your New Return: Before filing, it's crucial to review your new tax return for accuracy and completeness. We will discuss the importance of reviewing all information and making any necessary adjustments.

6.2 Filing Your New Return: Once you're satisfied with your new return, we will walk you through the process of filing it through TurboTax. We will explain the available filing options, such as e-filing or printing and mailing.

Start over on turbotax

Starting over on TurboTax is a manageable process that involves resetting your progress or creating a new tax return. By following the steps outlined in this guide, you can easily make a fresh start and ensure accurate tax filings. Remember to assess the need for starting over, reset your progress if necessary, and enter new information accurately. With TurboTax's user-friendly interface and our comprehensive guide, you can confidently navigate the process of starting over on TurboTax.