How REITs Resemble Mutual Funds: A Comprehensive Comparison

Real Estate Investment Trusts (REITs) and mutual funds are popular investment vehicles that offer individuals the opportunity to invest in diversified portfolios. While they have distinct characteristics, there are several ways in which REITs resemble mutual funds. In this article, we will explore the similarities between REITs and mutual funds, highlighting their shared features and benefits for investors.

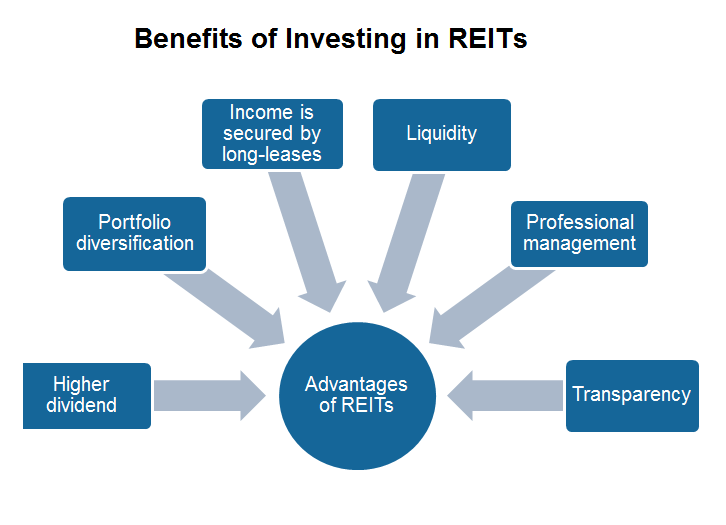

Benefits of investing in REITs

1. Definition of REITs and Mutual Funds

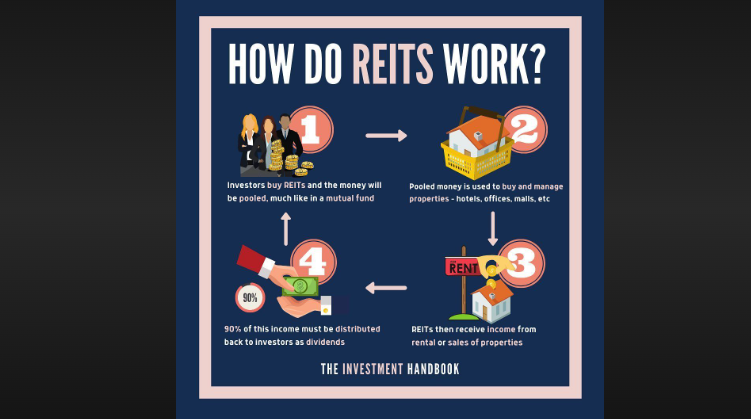

a. REITs: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. REITs allow investors to pool their capital to invest in a diversified portfolio of real estate assets.

b. Mutual Funds: A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or other assets.

2. Structure and Management

a. Pooling of Funds: Both REITs and mutual funds pool money from multiple investors, providing individual investors with an opportunity to access a diversified portfolio of assets that they may not be able to afford individually.

b. Professional Management: Both REITs and mutual funds are professionally managed by experienced portfolio managers or investment teams who make investment decisions on behalf of the investors.

3. Dividends and Distributions

a. Income Distribution: Both REITs and mutual funds distribute income to their investors in the form of dividends. REITs are required by law to distribute a significant portion of their taxable income to shareholders.

b. Capital Gains Distribution: Like mutual funds, REITs may also distribute capital gains to their investors when they sell properties at a profit.

4. Liquidity

a. Tradable Securities: Both REITs and mutual funds are typically traded on securities exchanges, allowing investors to buy or sell their shares on a daily basis at the prevailing market prices.

b. Easy Access: Investors can easily buy or sell shares of REITs and mutual funds through brokerage accounts, making them highly liquid investments.

5. Diversification

a. Portfolio Diversification: Both REITs and mutual funds provide investors with diversification benefits. REITs invest in a wide range of real estate properties, while mutual funds hold a diversified portfolio of securities across different asset classes.

b. Risk Mitigation: Diversification helps to spread risk across various investments, reducing the impact of individual asset performance on the overall portfolio.

6. Regulation and Transparency

a. Regulatory Oversight: Both REITs and mutual funds are subject to regulatory oversight to protect the interests of investors. REITs are regulated under specific laws that govern their structure and operation.

b. Reporting Requirements: REITs, like mutual funds, are required to provide regular financial reports and disclose information about their holdings, performance, and management.

7. Tax Considerations

a. Pass-Through Taxation: Similar to mutual funds, REITs are structured as pass-through entities, meaning they do not pay corporate income tax at the entity level. Instead, shareholders are responsible for reporting and paying taxes on their share of REIT income.

b. Tax Efficiency: Both REITs and mutual funds can offer tax advantages, such as the ability to offset capital gains with capital losses.

8. Investment Accessibility

a. Small Investment Options: Both REITs and mutual funds provide opportunities for investors with limited capital to gain exposure to a diversified portfolio of assets.

b. Professional Expertise: REITs and mutual funds allow investors to benefit from the expertise of professional portfolio managers who make investment decisions based on in-depth research and analysis.

Reits work

There are several ways in which REITs resemble mutual funds. Both investment vehicles offer investors the opportunity to access diversified portfolios, benefit from professional management, and enjoy liquidity through tradable securities. Additionally, they provide income distributions, diversification benefits, regulatory oversight, and tax considerations. Understanding the similarities between REITs and mutual funds can help investors make informed decisions based on their investment goals, risk tolerance, and preferences. Whether it's investing in real estate or traditional securities, REITs and mutual funds offer accessible and diversified investment options for individuals looking to grow their wealth.