Which of the Following Accounts Is Considered a Prepaid Expense?

In the realm of accounting, various types of financial transactions take place, and one important concept to understand is that of prepaid expenses. Prepaid expenses are considered assets on a company's balance sheet and are categorized as such due to their future economic benefits. In this article, we will delve into the topic of prepaid expenses, focusing on the question: "Which of the following accounts is considered a prepaid expense?" We will explore different types of accounts and provide insights to help you gain a comprehensive understanding.

1. Definition and Characteristics of Prepaid Expenses:

Prepaid Expenses

A prepaid expense is an expenditure made by a company for goods or services that are yet to be received or utilized.

These expenses are initially recorded as assets on the balance sheet and are gradually expensed over time as they are consumed or utilized.

The main characteristic of prepaid expenses is that they provide future benefits to the company beyond the current accounting period.

2. Types of Prepaid Expense Accounts:

2.1 Prepaid Insurance:

Prepaid insurance is a common example of a prepaid expense account.

When a company pays for insurance coverage in advance, the payment is recorded as a prepaid expense.

Over time, as the insurance coverage is utilized, the prepaid insurance account is gradually reduced, and the corresponding expense is recognized.

2.2 Prepaid Rent:

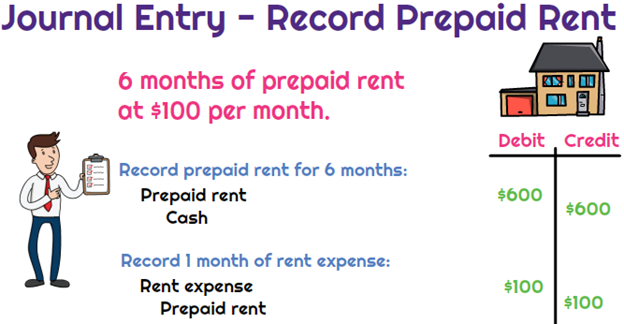

Prepaid Rent

Another common type of prepaid expense account is prepaid rent.

When a company pays rent in advance, it is recorded as a prepaid expense.

As each month passes and the company occupies the rented space, a portion of the prepaid rent is recognized as an expense on the income statement.

2.3 Prepaid Subscriptions:

Prepaid subscriptions represent payments made in advance for services or publications.

For example, if a company pays for an annual subscription to a software platform or a magazine, it would record the payment as a prepaid expense.

As the subscription period progresses, the company gradually recognizes the expense associated with the prepaid subscription.

2.4 Prepaid Advertising:

Companies often engage in advertising campaigns to promote their products or services.

If a company pays for advertising in advance, it is considered a prepaid expense.

As the advertisements are published or aired, the prepaid advertising account is reduced, and the corresponding expense is recognized.

2.5 Prepaid Maintenance and Service Contracts:

Many companies enter into maintenance or service contracts for equipment, machinery, or software.

Payments made in advance for these contracts are recorded as prepaid expenses.

As the services are rendered or the maintenance is performed, the prepaid expense account is decreased, and the corresponding expense is recognized.

Understanding prepaid expenses is crucial for proper accounting and financial reporting. The accounts considered as prepaid expenses include prepaid insurance, prepaid rent, prepaid subscriptions, prepaid advertising, and prepaid maintenance and service contracts. These accounts reflect expenses paid in advance and gradually recognized as expenses over time. By identifying and properly accounting for prepaid expenses, companies can accurately depict their financial position and effectively manage their resources.