Which Statement Best Describes the Main Cause of the 2008 Housing Market Crash in the United States?

The 2008 housing market crash in the United States had far-reaching implications, leading to a global financial crisis. Understanding the primary cause of this crash is crucial to prevent similar events in the future. This article explores various factors that contributed to the collapse and aims to identify the statement that best describes the main cause of the crisis.

What caused the Great Recession?

1. Subprime Mortgage Lending:

One of the key factors leading to the housing market crash was the proliferation of subprime mortgage lending. Financial institutions offered mortgages to borrowers with low creditworthiness and inadequate income verification. The subprime lending bubble eventually burst, causing widespread defaults and foreclosures.

2. Securitization and Mortgage-backed Securities (MBS):

The rise of securitization and mortgage-backed securities played a significant role in the housing market crash. Banks bundled mortgage loans together and sold them as investment products, thereby spreading the risk among various investors. However, the complexity and lack of transparency in these securities led to uncertainty and the eventual collapse of the market.

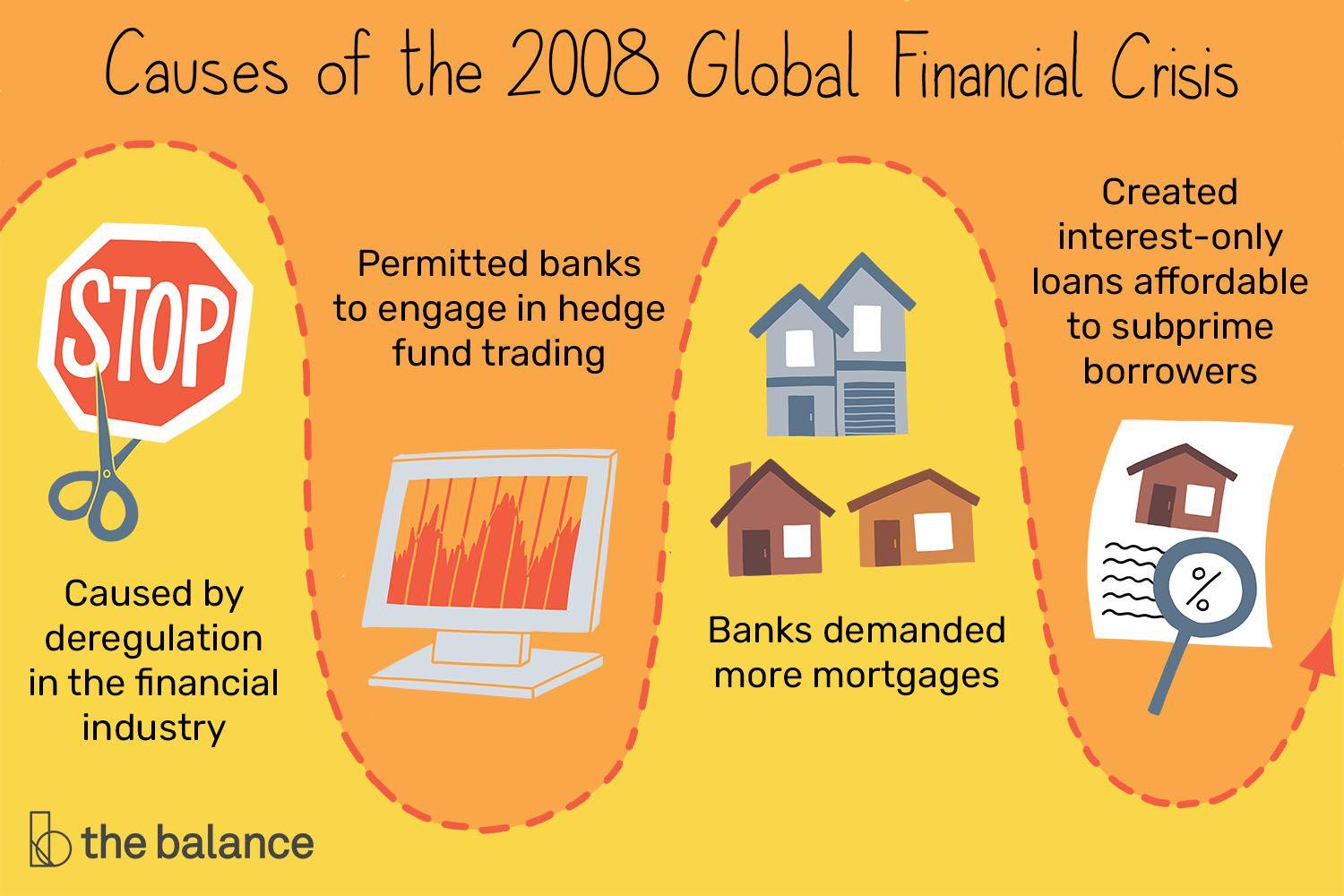

3. Deregulation and Lack of Oversight:

Deregulation in the financial industry, particularly the repeal of the Glass-Steagall Act in 1999, allowed commercial and investment banks to engage in riskier activities. The lack of effective oversight and regulation allowed financial institutions to take excessive risks, contributing to the housing market crash.

What caused 2008 global financial crisis

4. Housing Price Bubble:

During the early 2000s, there was a rapid increase in housing prices, driven by speculation, easy credit, and the belief that prices would continue to rise indefinitely. However, the unsustainable growth in housing prices eventually led to a burst of the bubble, causing a downward spiral in the market.

5. Financial Industry Practices:

Unsound practices within the financial industry, such as predatory lending, inflated property appraisals, and the issuance of risky mortgage products, played a significant role in the housing market crash. These practices misled borrowers and investors, leading to an unsustainable market.

While several factors contributed to the 2008 housing market crash in the United States, the main cause can be attributed to the combination of subprime mortgage lending and the subsequent collapse of the securitized mortgage market. The proliferation of subprime loans, combined with the complexity and lack of transparency in mortgage-backed securities, created a chain reaction of defaults and foreclosures, ultimately destabilizing the housing market and triggering a global financial crisis. Understanding these causes is essential for implementing effective regulations and practices to prevent similar crises in the future.