Understanding Non-Sequential Bills: What You Need to Know

In the world of currency and money handling, non-sequential bills play a significant role. These bills, also known as non-consecutive bills or non-sequential banknotes, are unique and distinct from the usual sequential series of banknotes. In this article, we will delve into the concept of non-sequential bills, their importance, and their various applications. Join us as we explore the fascinating world of non-sequential bills and uncover their significance in the realm of finance.

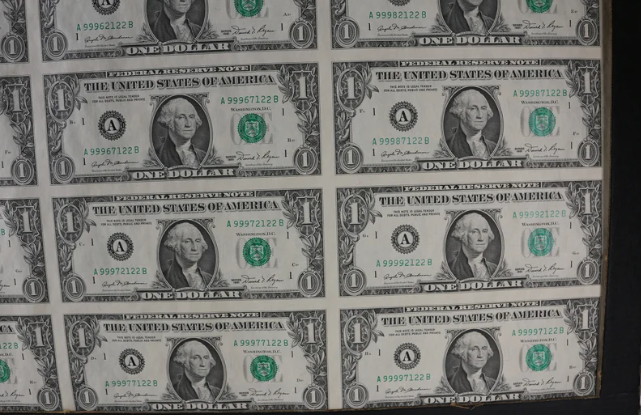

Series number on Dolla

1. What Are Non-Sequential Bills?

- Definition: Gain a clear understanding of what non-sequential bills are and how they differ from sequential banknotes.

- Characteristics: Explore the unique features and identifiers that set non-sequential bills apart from traditional banknotes.

2. The Purpose of Non-Sequential Bills

- Enhanced Security: Learn how non-sequential bills contribute to enhanced security measures in the banking and financial sectors.

- Counterfeit Prevention: Discover how non-sequential bills help combat counterfeit activities and safeguard against fraud.

- Tracking and Tracing: Explore the role of non-sequential bills in tracking and tracing money movements, particularly in legal and regulatory processes.

3. Applications of Non-Sequential Bills

- Money Transfers: Understand how non-sequential bills facilitate secure and efficient money transfers, both domestically and internationally.

- Gambling and Casinos: Learn about the use of non-sequential bills in casinos and gambling establishments to prevent illicit activities.

- Law Enforcement: Discover how non-sequential bills aid law enforcement agencies in investigations and asset tracking.

- Confidential Transactions: Explore the role of non-sequential bills in confidential transactions, such as charitable donations and anonymous purchases.

4. The Benefits and Limitations of Non-Sequential Bills

- Advantages: Explore the benefits of using non-sequential bills, including increased security, traceability, and ease of verification.

- Limitations: Discuss the limitations and challenges associated with non-sequential bills, such as limited availability and potential logistical issues.

Non-consecutive bills

Non-sequential bills are a crucial component of the financial system, offering enhanced security and protection against counterfeiting and fraud. With their unique characteristics and applications in various sectors, these banknotes play a significant role in ensuring the integrity and traceability of monetary transactions. Whether it's in money transfers, gambling establishments, or law enforcement, non-sequential bills provide an additional layer of security and confidence. As technology advances, we can expect further developments in the realm of non-sequential bills, further strengthening the global financial landscape.