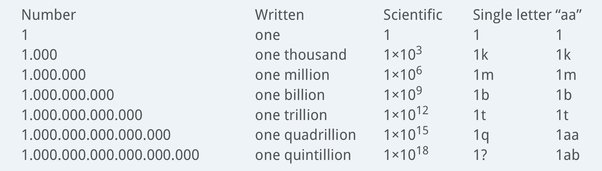

What Does AA Mean in Money?

Money is an essential aspect of our lives, and understanding the various terminologies associated with it is crucial. One such term is "AA." In this article, we will explore what AA means in the context of money and delve into its significance. Whether you are a finance enthusiast or simply curious about financial terms, this article will provide you with the necessary insights.

AA Mean in Money

1. Defining AA:

AA is an abbreviation commonly used in the realm of finance, particularly in credit ratings.

It stands for "Adequate Assurance" and is often used by credit rating agencies to assess the creditworthiness of an individual or an entity.

The AA rating signifies a high level of confidence in the borrower's ability to meet their financial obligations.

2. Understanding Credit Ratings:

To comprehend the significance of AA in money, it is essential to have a basic understanding of credit ratings.

Credit rating agencies evaluate the creditworthiness of borrowers, such as governments, corporations, or individuals, and assign them ratings.

These ratings reflect the borrower's ability to repay their debts and are crucial for investors and lenders in making informed decisions.

3. The Importance of AA:

AA is considered a desirable credit rating and is indicative of a low default risk.

When an individual or entity is assigned an AA rating, it means they have a strong capacity to honor their financial commitments.

This rating enables them to access loans and credit facilities at favorable terms, including lower interest rates.

Furthermore, AA-rated investments are often perceived as safe and reliable by investors.

4. Factors Considered in AA Ratings:

Credit rating agencies use various factors to determine an individual or entity's creditworthiness and assign them an AA rating.

These factors typically include financial stability, historical repayment track record, cash flow analysis, debt levels, and overall financial health.

A thorough evaluation of these aspects helps credit rating agencies assess the borrower's ability to meet their obligations.

AA Mean in Money

5. Comparing AA with Other Ratings:

While AA is considered a strong credit rating, it falls below the highest rating tiers such as AAA (Triple-A).

AAA is the highest rating given by credit rating agencies and represents the lowest default risk.

However, AA is still a highly favorable rating, indicating a solid financial position and a relatively low level of risk.

6. Impact on Borrowers and Investors:

For borrowers with an AA rating, the benefits extend beyond access to credit.

These borrowers can negotiate better terms with lenders, including longer repayment periods and lower collateral requirements.

On the other hand, investors often seek out AA-rated investments as they offer a balance between stability and yield.

AA-rated bonds, for example, tend to have lower interest rates compared to lower-rated bonds.

7. Limitations of Credit Ratings:

While credit ratings provide valuable insights, it is important to recognize their limitations.

Ratings are based on historical data and may not always capture future financial challenges or market shifts.

Additionally, credit rating agencies can have different methodologies and criteria, leading to variations in ratings across agencies.

It is crucial for investors and borrowers to conduct thorough research and consider multiple factors beyond credit ratings alone.

In the world of finance, AA holds significant importance as it represents a favorable credit rating denoting a strong ability to meet financial obligations. Borrowers with an AA rating enjoy benefits such as easier access to credit and favorable terms, while investors find AA-rated investments attractive due to their perceived stability. Understanding credit ratings and their implications is crucial for making informed financial decisions. However, it is important to acknowledge the limitations of credit ratings and consider them alongside other relevant factors.